In most cities we visit these days, apartment community staffers tell us that many residents work from home, at least part of the time. The truth of this is often evident as we tour these communities – we see people working in lounges, conference rooms and even by the pool.

It’s a trend that has notable implications for apartment communities. It’s also something that varies significantly by city.

A recent visit to Denver got us wondering about the growth of people working at home and the differences between cities. We’ll explain why in a moment.

Data from American Community Survey

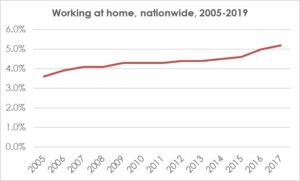

Working at home is on the rise

In 2017, 5.2% of U.S. workers worked from home (American Community Survey). That’s up from 4.3% in 2010 and 3.6% in 2005. And that only counts people who work mostly from home. More than 9.4% of workers worked from home at least one day per week in 2010, up from 7.0% in 2000 (Census Bureau Survey of Income and Program Participation).

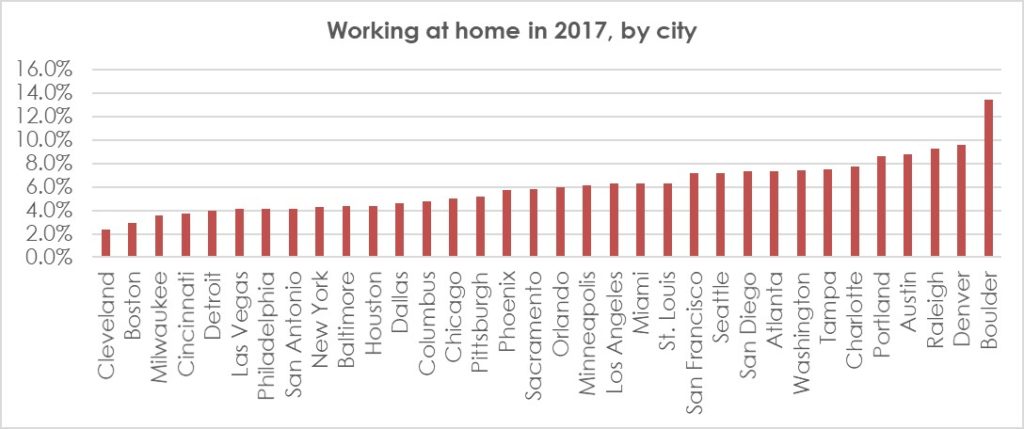

Working from home varies significantly by city

The reason our Denver visit got us thinking about the subject is that we saw so many people working from common areas in buildings there – many more than in Seattle, where working from home is also common. And statistics bear this out. In 2017, 9.6% of Denver residents worked mostly from home – a higher share than we found for any other major city (we looked at more than 30).

A deeper dive found that cities with high shares of people working from home tend to be desirable places to live and/or have significant knowledge employment. Examples other than Denver include Raleigh (9.3% working mostly from home), Austin (8.8%) and Portland, Ore. (8.6%). The ultimate example of a destination city (albeit smaller than the others we looked into) appears to be Boulder, where 13.4% of workers work mostly from home.

In contrast, cities with low shares of people working from home tend to be, well, older and colder. Examples include Cleveland (just 2.4% of workers working from home), Boston (2.9%), Milwaukee (3.6%) and Cincinnati (3.7%).

Data from American Community Survey

Catering to home workers

Even in cities with somewhat lower shares of people working from home, it can make sense to cater to this audience. This is particularly true when considering people who work from home just part of the time. That’s because this audience includes many young, highly educated professionals who make up a significant share of the target audience for luxury apartment communities.

It’s not new that many developers are including workspaces in apartment communities. But we have noticed a couple of takeaways from recent tours. One is that, while residents appreciate work-friendly amenities, they’re not necessarily looking for a traditional business center. Rather, modern tech offices and coworking spaces have popularized working in spaces that are remarkably like traditional amenity lounges – with couches, chairs, tables and kitchens, plus a couple of conference/phone rooms for when privacy is needed. One building we recently toured in Denver was planning to cut into its theater room to create private work pods in its lounge. A leasing agent at another, newer building said its large business center is a big selling point, but people more often work in the lounge, which has much more natural light.

Work-friendly lounge at the St Paul Collection, in Denver (left); Lounge with private work pods at Emme, in Chicago (right)

Many developers are also including more work-oriented features in units, such as built-in desks. We’re seeing a growing trend of renters seeking two-bedroom or one-bedroom den units so they can have an actual office, rather than just a desk. Designing units with a true home office in mind might be smart.

Built-in desk in a unit at Gables on Speer, in Denver (left); Study in a unit at the St. Paul Collection, in Denver (right)

The bottom line is that working from home has been on the rise for a while now and appears to be an established trend, particularly in destination and knowledge-economy cities. We at Red Propeller look at these types of trends to think about opportunities form multifamily projects to continue to evolve to meet the changing needs of residents.